Understanding US Tariffs

US tariffs have a long and varied history, impacting trade policies and economic strategies. These tariffs play a crucial role in shaping modern economies and addressing issues like unfair trade practices and the need for reciprocal tariffs.

Historical Context of US Trade Policy

Trade policy in the United States has evolved over centuries, often influenced by economic and political needs. Early on, tariffs served as the primary source of revenue for the federal government. The focus was mainly on protecting burgeoning industries from foreign competition. Over time, the role of tariffs shifted, aiming to balance economic protection with global trade relations.

In recent years, the Trump administration emphasized tariffs to address unfair trade practices and to promote fair trade. This included imposing tariffs on a wide range of imports to protect domestic industries and jobs. These moves sparked debates about their effectiveness and impact on global trade relations. Tariffs have historically served as a tool for negotiating trade agreements and closing economic gaps between countries.

The Role of Tariffs in Modern Economies

In today’s global economy, tariffs continue to be a strategic tool. They help generate revenue for governments and protect local industries. Tariffs can also be used to encourage countries to eliminate unfair trade practices by promoting reciprocal tariffs, which aim to create a level playing field.

Modern tariffs are more targeted and focus on specific goods and industries, reflecting economic priorities and strategic interests. The scope of products subject to tariffs often expands to cover new areas, as seen during the Trump administration.

While tariffs can protect domestic jobs and industries, they may also lead to higher prices for consumers. The challenge is to find a balance that supports economic growth while maintaining fair trade practices.

Impact of US Tariffs on Global Trade

US tariffs are reshaping global trade dynamics by influencing international trade policies and impacting businesses worldwide. These measures affect trade balances and the strategic decisions of multinational corporations.

Trade War Dynamics

Trade wars often arise from tariff measures designed to address trade imbalances. When the US implements tariffs, other countries may retaliate with their own, which can escalate into a trade war. This back-and-forth can disrupt global trade by creating tensions among key international players such as the US, China, and the EU.

Increased tariffs can lead to higher costs for imported goods, affecting consumer prices and reducing demand. This environment can destabilize markets, making it harder for businesses to forecast and plan. The effects on the trade deficit can vary, but tariffs typically aim to reduce the gap by discouraging imports.

Implications for Multinational Corporations

Multinational corporations face challenges when tariffs increase, impacting their supply chains and bottom lines. These companies may need to adjust their operations by moving production to different countries or sourcing materials from less-affected regions to minimize the impact on costs.

Such strategic changes can involve significant investment and risks. For instance, adjustments to supply chains may incur logistics challenges and affect the companies’ agility. Additionally, tariffs can influence currency values, adding another layer of complexity.

To navigate tariff-related changes, businesses must stay informed about evolving trade regulations. Companies may then develop proactive strategies to safeguard their global presence and continue operating smoothly amidst the uncertainty.

Leadership Challenges in the Tariff Landscape

Leaders in industries affected by US tariffs face unique challenges. They must make strategic decisions while managing compliance and assessing risks in a changing economic environment.

Strategic Decision Making

The introduction of tariffs requires leadership to navigate complex market changes. Companies may face increased costs due to tariffs on imports like steel and electronics, affecting pricing strategies and profit margins. Leaders must evaluate when to pass costs onto consumers or absorb them to remain competitive. They also need to consider opportunities for sourcing materials locally or restructuring supply chains to mitigate tariff impacts. Aligning these strategies with company goals is critical for maintaining market position and customer loyalty.

Navigating Compliance and Risk Assessment

Compliance becomes complex under new tariff policies. Leaders must ensure their companies adhere to international trade laws and monitor changing regulations. Risk assessment is crucial, as tariffs introduce uncertainty in supply chains. Many HR professionals express concern over job security, and it’s vital for leaders to evaluate potential workforce implications. Understanding these elements helps in developing risk management plans that safeguard company operations. Detailed scrutiny of procurement practices, especially for government contractors, is necessary to manage increased costs and maintain contract obligations.

Tariffs and Workplace Dynamics

US tariffs have reshaped how businesses operate and organize their supply chains. These changes influence the leadership needed to navigate new challenges in operations and logistics.

Effect on Business Operations

Tariff policies impact business operations by increasing the cost of imported goods. Companies often face higher expenses, leading them to rethink their strategies to maintain profit margins. Management must negotiate with suppliers or find local alternatives to minimize costs. This adjustment demands strong leadership to handle operational changes and maintain workforce morale.

Business leaders must stay informed about tariff changes and how they impact specific industries. Some companies may increase prices, affecting their competitive edge. Others may need to streamline processes, placing more pressure on staff to increase productivity. This dynamic environment requires leaders who can effectively communicate changes and support their teams through transitions.

Supply Chain Adjustments

Tariffs force companies to re-evaluate their supply chains to offset rising costs. Businesses might shift from international suppliers to domestic ones or diversify their supplier base to mitigate risks. Strong planning and risk management are necessary to implement these adjustments smoothly.

Leaders must focus on strengthening relationships with suppliers and securing reliable sources. This often involves re-negotiating contracts and terms. With tariffs affecting industries like manufacturing and retail, leaders are tasked with adapting logistics strategies. They need to ensure timely delivery of goods despite any disruptions caused by tariff changes. A proactive approach helps businesses remain agile and competitive under shifting economic conditions.

Economic Implications of US Tariffs

US tariffs have significant effects on the economy, influencing inflation and consumer prices. These measures can lead to changes in production costs and affect the cost of goods and services for consumers.

Inflation Expectations

Tariffs can impact inflation expectations as they increase the cost of imported goods. When tariffs are imposed, businesses may face higher costs for raw materials and products they need to import. Companies often pass these costs onto consumers, leading to price increases.

If businesses believe tariffs will persist, they may expect continued price rises, which can shift market behavior. Inflation expectations play a crucial role in economic decision-making, as businesses and consumers adjust their spending and saving habits based on anticipated price changes.

Higher Inflation and Consumer Prices

Higher tariffs generally lead to higher consumer prices. For instance, new tariffs could raise revenue by nearly 1.3% of U.S. GDP, leading to the largest tax increase since 1968, according to J.P. Morgan Research. This increase affects the affordability of goods, particularly imported products from countries like China and Mexico.

As consumer prices rise, purchasing power decreases, potentially reducing demand for non-essential goods. Families face higher expenses, impacting everyday spending. These changes can slow economic growth, with households spending more on basics and less on other items. Companies might hesitate to invest, fearing reduced consumer demand and rising operational costs.

Media’s Role in Shaping Perception

Media plays a crucial role in how the public perceives tariffs and their impact on the economy and workplace leadership. The coverage of tariffs can influence public opinion on policies enacted during the Trump administration.

Coverage of Tariff Policies

Media outlets extensively cover how tariffs are set and enforced. They analyze the political implications and economic outcomes. Many reports have highlighted how tariffs were used by the Trump administration as a tool to protect domestic industries.

Media discussion often focuses on the advantages and disadvantages of tariffs. News articles, like those on UVA Today, explain shifts from traditional revenue-raising tariffs toward ones targeting trade fairness. Coverage by Brookings further delves into the executive branch’s growing power to impose tariffs without Congress.

Public Opinion and Media Influence

Public perception of tariffs can be heavily swayed by media framing. Reports highlighting tariff impacts on consumer prices and trade relations are pivotal in shaping opinions. Media can sometimes amplify opposing views, leading to public debates.

Studies indicate that news coverage can polarize or unite public sentiment, depending on its tone and the facts presented. The AP points out the mixed messages during tariff negotiations, leaving both confusion and criticism of economic strategies. Ultimately, the media plays a significant role in shaping how policies are viewed by the public.

Adapting to Non-Tariff Barriers

Non-tariff barriers present unique challenges. Businesses must navigate these challenges carefully to maintain competitiveness. Addressing non-tariff measures and their impacts, like those on value-added tax, is crucial for sound business strategies.

Understanding Non-Tariff Measures

Non-tariff measures (NTMs) include regulations that countries use to control the amount of trade across their borders. These can cover various actions like quotas, embargoes, and certification requirements. Such barriers impact how businesses engage in global trade by increasing compliance costs and technical barriers.

To adapt, companies must be well-informed about the NTMs that apply to their products. They should develop strategies to tackle these barriers, like streamlining internal processes or finding alternative markets. Emphasizing efficiency and modifying supply chains can help reduce the costs associated with NTMs.

Effect on Value-Added Tax

Value-added tax (VAT) is another crucial element affected by non-tariff barriers. When goods cross borders and encounter NTMs, VAT processes can become complex. These barriers can lead to increased administrative tasks, affecting cash flow and overall tax liability for a company.

Companies need to understand how NTMs influence VAT rules. This understanding is important to optimize tax expenditures and ensure compliance. By investing in VAT expertise and leveraging specialized software, businesses can better manage these complexities. This results in improved financial efficiency and minimized disruptions in operations.

Technology and Tariffs

The recent shifts in U.S. tariffs have a significant impact on the tech industry. With increased tariffs, the costs for imported hardware and components are rising. This means companies may need to reassess their budgets or even adjust their strategies to cope with higher expenses.

Many tech firms are facing supply chain disruptions as they try to navigate these new costs. This may lead them to seek alternatives or invest in local manufacturing to reduce dependency on imports. Such changes often require time and resources.

These tariffs may also influence global IT spending. As prices rise, some businesses might cut back on technology investments or delay upgrades. This can slow down innovation or affect the competitiveness of U.S. tech firms.

Key Impacts on the Tech Industry:

- Increased Costs: Higher tariffs mean pricier imported components.

- Supply Chain: Challenges in maintaining a steady supply due to cost pressures.

- Investment Shifts: Companies might focus more on local manufacturing.

Importers are on the front line dealing with these changes. They need to strategize on how to absorb costs or pass them on to consumers. Some might look for tariff exemptions or renegotiate terms with suppliers to soften the blow of these tariffs.

Takeaways

The recent round of tariffs introduced by President Trump has led to significant changes in leadership strategies within the workplace. Many companies are adjusting their outlooks and methods to cope with these economic shifts.

Leaders are now focusing on diversifying supply chains to minimize risks. By sourcing materials from different countries, they can reduce dependence on any single region. This approach helps in maintaining stable production despite global trade changes.

Corporate leaders are also emphasizing cost-cutting innovations. Businesses are seeking new technologies and processes to lower expenses while maintaining quality. This includes investing in automation and digital transformation to enhance efficiency.

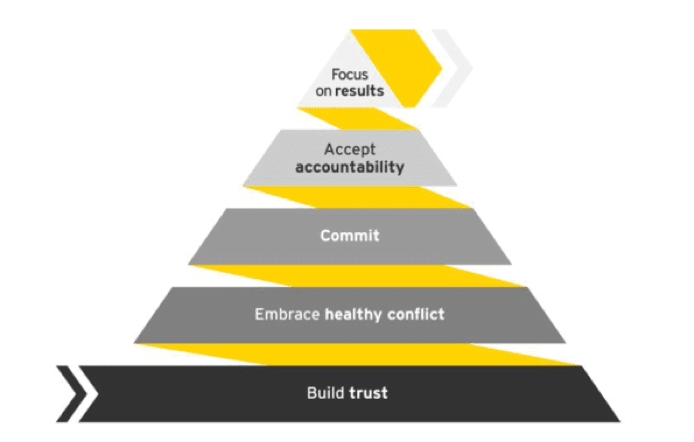

Another key area of focus is communication strategies. Effective communication with employees and stakeholders is crucial. Leaders are transparent about challenges and potential impacts on the business. This openness builds trust and encourages collaboration and adaptability in uncertain times.

Finally, when tariffs increase, so does the interest in advocacy and lobbying. Many companies are actively engaging with policymakers to express their concerns and preferences regarding trade policies. Their goal is to shape future regulations that benefit their industry and workforce.

By understanding and implementing these strategies, businesses can navigate the challenges posed by tariffs while maintaining a strong position in the market.